Expert Insights: How Equity Analysis Improves Your Returns

In the contemporary ever-changing economic environment, traders are always seeking approaches to boost their profits while controlling hazards. equity research report of the most productive strategies to achieve this is through equity analysis, which provides a deep insight of the equity market and specific companies. By leveraging the expertise of equity analysis specialists, investors can obtain insightful understandings that lead to better intelligent decisions and, ultimately, improved financial outcomes.

Equity analysis involves assessing a company's economic status, market position, and potential for growth. This approach can uncover latent gems that might otherwise go unrecognized. By engaging with equity analysis professionals, participants can analyze intricate data, employ sophisticated tools, and understand market patterns, ensuring they remain in front of the curve in an progressively challenging landscape. Taking on this systematic approach not just empowers investors to maximize their gains and also fosters a more substantial trust in their decisions.

Comprehending Stock Analysis

Stock evaluation is a critical process that involves evaluating a business's economic results and future potential to make educated financial choices. By scrutinizing various financial metrics and industry trends, equity analysts can determine the intrinsic value of a stock, helping investors comprehend whether it is overpriced or undervalued. This evaluation is important for individuals looking to attain an edge in the challenging arena of investing, as it enables tactical choices based on data rather than guesswork.

At its core, stock evaluation can be divided into two primary methods: fundamental analysis and chart analysis. Fundamental analysis focuses on analyzing the underlying economic well-being of a company, including its earnings, revenue, and overall economic reports. On the other hand, technical analysis looks at market patterns and price changes to forecast future actions. Together, these approaches provide a holistic insight of a firm's standing in the industry and its potential for growth.

Collaborating with stock evaluation specialists can greatly improve an investor ability to formulate smart choices. These experts possess the knowledge and skills to analyze intricate information and spot investment opportunities that may not be visible to the typical shareholder. Their perspectives can lead to better investment strategies, ultimately improving returns and minimizing threats in a portfolio. By utilizing the knowledge of equity analysis professionals, shareholders can navigate the financial marketplace with greater confidence.

Key Metrics for Assessing Investments

When evaluating potential investments through equity analysis, several key metrics stand out as crucial tools for investors. Price-to-Earnings ratio, or P/E ratio, represents one such metric which helps investors ascertain the relative value of a company’s shares. A elevated P/E ratio may indicate to a stock is overvalued or as investors are expecting high growth rates in the future. On the other hand, a low P/E ratio might suggest to a stock is undervalued and that the company is experiencing challenges. Understanding this ratio can guide investors in deciding informed decisions about when to buy or sell stocks.

Another important metric is the Return on Equity, or ROE, that measures a company's profitability in relation to shareholders' equity. This figure provides insights into how effectively a company is equity to generate profits. A consistently high ROE can indicate that the company remains efficient at converting investment into net income, which attracts more investors. On the flip side, a reducing ROE may prompt a review of the company’s operational effectiveness. Investors ought to consider ROE alongside other metrics to gain a holistic view of a company's financial health.

Lastly, the Debt to Equity ratio represents crucial for assessing the financial leverage of a company. This ratio shows the proportion of debt financing relative to equity, providing insights into risk factors. A high Debt to Equity ratio might indicate potential financial instability, especially in volatile economic conditions, while a diminished ratio suggests a more conservative approach to financing. Investors utilizing equity analysis must keep these metrics in mind, as they highlight different aspects of a company’s performance and risk profile, ultimately aiding in making informed investment decisions.

Effective Strategies for Successful Stock Evaluation

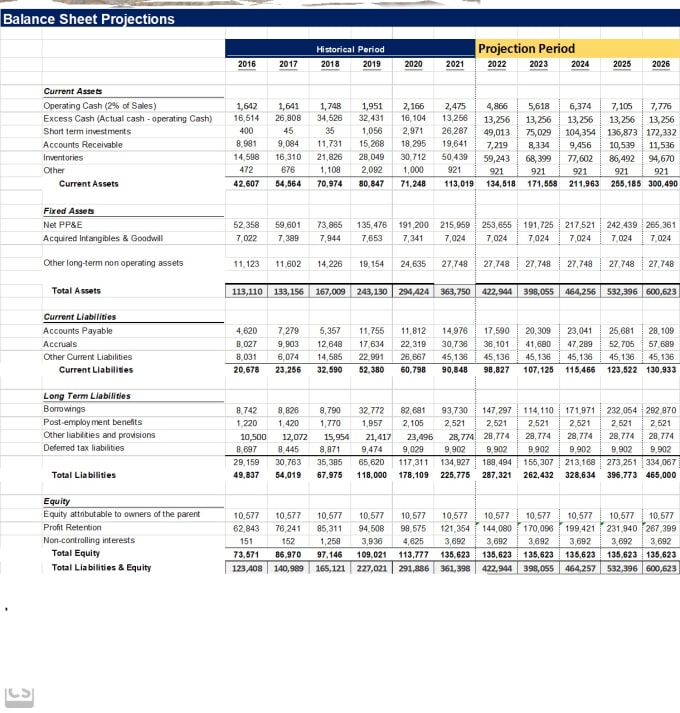

To conduct successful equity evaluation, it's important to start with a thorough grasp of the company's fundamentals. Focus on key financial documents such as the income statement, financial position statement, and cash flow statement. Examine revenue increase, profit margins, debt levels, and cash flow trends to assess the company's financial well-being. By identifying strengths and weaknesses in these areas, you can create a more educated opinion about the company's future outlook.

Next, incorporate market and industry evaluation into your stock evaluation process. Assess the competitive landscape, including market trends, regulatory changes, and economic factors that may impact the company. Understanding the broader context in which the company operates will help you recognize potential risks and opportunities. Additionally, comparing the company's results against its competitors can provide valuable insights into its relative position in the market.

Finally, take advantage of the expertise of equity analysis specialists to enhance your investment approach. These experts can provide deeper insights and nuanced interpretations of data that may not be readily observable. Working together with analysts who have extensive expertise and knowledge in specific fields can lead to more accurate valuations and better investment decisions. Make use of their reports, recommendations, and research to enhance your evaluation and improve your chances of achieving strong returns.